Protecting members’ funds

Modern Woodmen makes financial decisions in the best interest of our members, and they can be confident in our ability to meet short- and long-term obligations – no matter what’s going on in the world.

We’ve weathered world wars, disease outbreaks, depressions and recessions. Read stories of strength from our organization's history.

Financial strength: 5 facts to know

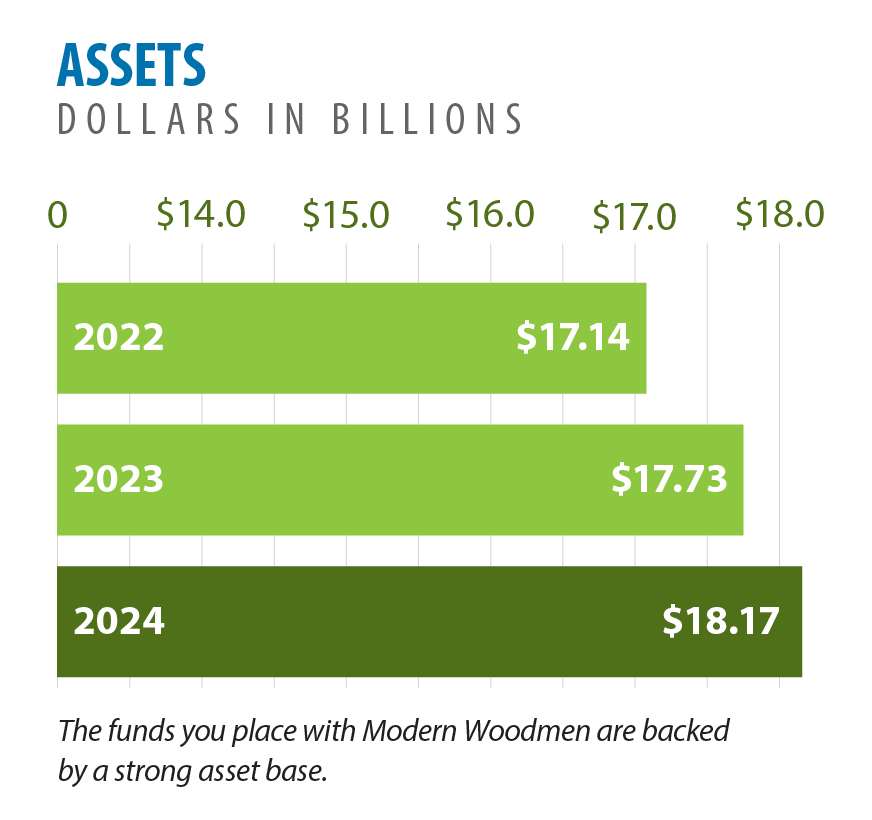

1. Modern Woodmen’s asset base is a strength

At year-end 2024, assets equaled $18.17 billion. All of the funds members place with Modern Woodmen are backed by these assets. Modern Woodmen’s assets, along with liabilities, declined in 2021 due to a one-time reinsurance transaction.

2. Our investment philosophy safeguards members’ principal

Modern Woodmen manages its assets so that changes in the financial markets – recessions, depressions or periods of inflation – have minimal effect. Modern Woodmen is also careful not to follow investment fads. To build our investment portfolio, our financial management team follows these principles:

- High-quality investments.

- Diversified investments.

- Competitive rates of return.

Assets are invested primarily in high-quality, low-risk investments. As of Dec. 31, 2024, approximately 98.5% of bonds were of high or medium quality.

3. Our industry ratings are high

Modern Woodmen’s financial strength is rated A (Excellent), the third highest of 13 ratings, by A.M. Best, an independent rating agency. A.M. Best’s issuer credit rating for Modern Woodmen is a+ (Excellent), the fifth highest of 21 ratings.

Additionally, KBRA has assigned Modern Woodmen an insurance financial strength rating of AA-, the fourth highest of its 22 rating categories.

4. Surplus and reserves provide additional protection to members

- Modern Woodmen’s total surplus was $2.6 billion at the end of 2024. Surplus provides additional safety for members and ensures Modern Woodmen’s ability to meet unforeseen contingencies and provide funds for future growth.

- Total life insurance, annuity and other certificate reserves totaled $10.8 billion. These reserves are funds held to guarantee future benefits to members.

- Modern Woodmen’s solvency ratio reached 116.67%. This means that for every $100 of liabilities – promises made to members – Modern Woodmen has $116.67 in assets to back up those promises.

5. Modern Woodmen adheres to state insurance department regulations to protect consumers

Modern Woodmen and other life insurance and annuity providers are highly regulated by state insurance departments. Regulations, such as the amount of reserves to set aside and the risk level of investments, provide additional protection to members.